Blog: Are you ready for IR35?

- Tax

- UK Business

- 5 Min Read

HMRC are working on reforming current policies to ensure contractors who are essentially working like an employee – but through a personal service company (PSC) and thus paying lower tax rates – are brought in line to pay broadly the same amount of tax and National Insurance as those who are employed directly. These rules are sometimes known as ‘IR35’.

IR35 essentially deters contractors from diverting their payroll through a registered company, paying themselves a reduced salary and taking tax-free payments through their dividends allowance.

The changes were due to come into effect on 6 April 2020 but this has now been delayed until April 2021 to help businesses and individuals deal with the economic impact of Covid-19.

The term personal service company usually refers to a limited company that has been set up to provide the services of a single contractor, who is usually the sole shareholder and director, but it can also refer to a partnership (an association of two or more people as partners), or a sole trader. The umbrella term for these personal service companies, partnerships, and sole traders is ‘intermediaries’.

What is changing?

From April 2021, if a contractor is deemed, on balance, to be an employee, the fees they’re paid will be subject to income tax and National Insurance.

All public, medium and large private sector businesses will be responsible for deciding whether a contractor is an employee or not.

If a contractor only provides services to small clients in the private sector, they (the contractor) will remain responsible for establishing if the particular contract falls into off-payroll rules, and whether they need to pay the income tax and National Insurance due (as opposed to filing tax returns and paying liabilities as before).

It’s also worth noting that if a contractor works for more than one organisation through a personal service company, it doesn’t mean they’re automatically considered a contractor and exempt from off-payroll working rules; each contract must be reviewed on its own merit and there may be incidences where a contractor is working on some contracts as an employee and others as an independent.

Tests of employment

There are three main tests of employment used to determine a contractor’s employment status, and therefore whether the off-payroll working rules apply:

- Control

How much control does the individual have over when they work, how they work, where they work and what they work on?

Employees are usually told where and when they work, and are held to their employer’s standards. - Substitution

Can someone else be sent to do the work in place of that individual?

Whereas employees are usually required to carry out the work they’re employed to do, a self-employed or independent contractor may sometimes provide a substitute or sub-contract the work instead. - Mutuality of obligation

Is the client obliged to provide the individual with work, and is the individual obliged to accept it?

In addition to the above there are a host of other factors that may be taken into account, including:

- Who has the financial risk

- Who provides the equipment

- How integrated into the organisation the individual is are – for example, do they have a company email address

If, when assessing all of these factors and more the balance of probability is that the person is considered an employee, the new IR35/off-payroll rules will kick in and tax and National Insurance contributions will be deducted from their fees and paid to HMRC.

HMRC has a wealth of information to help determine a contractors’ status, including an online checker for employers and a helpful flowchart for contractors.

Following review, the client (employer) should provide the worker (contractor) with a ‘Status Determination Statement’ advising if the new rules apply and explaining the decision.

A contractor may dispute the Determination, but they’ll need to provide reasons for this and must raise the disagreement before the last payment is made to them.

A few things to take note of

- It is important that each contractor is assessed separately from others, even if they are doing similar work. This is to ensure that the criteria for off-payroll workers are considered in detail in each case. Any inquiry into a contractors’ status will be looked at on an individual basis, so conducting reviews for each worker means you’ll be able to explain your decision quickly and thoroughly

- These rules only apply to individuals who are working as employees, and not those who are genuinely self-employed who have their own business structure or employ others to work for them. In these circumstances, the individual will remain responsible for filing their own tax returns and paying their tax liability. However, each contract still needs to be assessed individually; even if someone is considered self-employed, they may have particular contracts that could be deemed as employment if they meet some of the employment tests mentioned above.

How it looks in practice

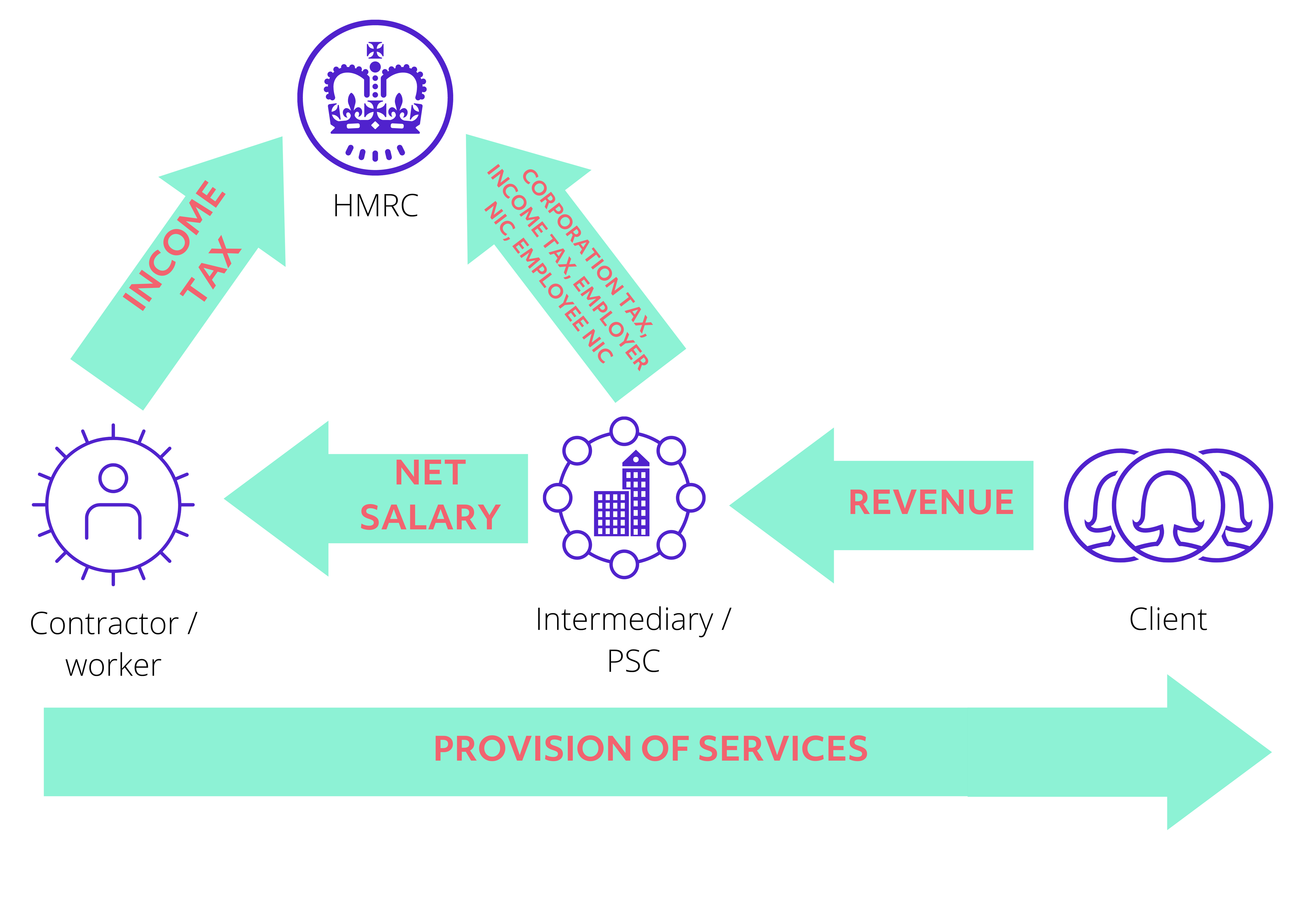

1: Current situation: disguised employment

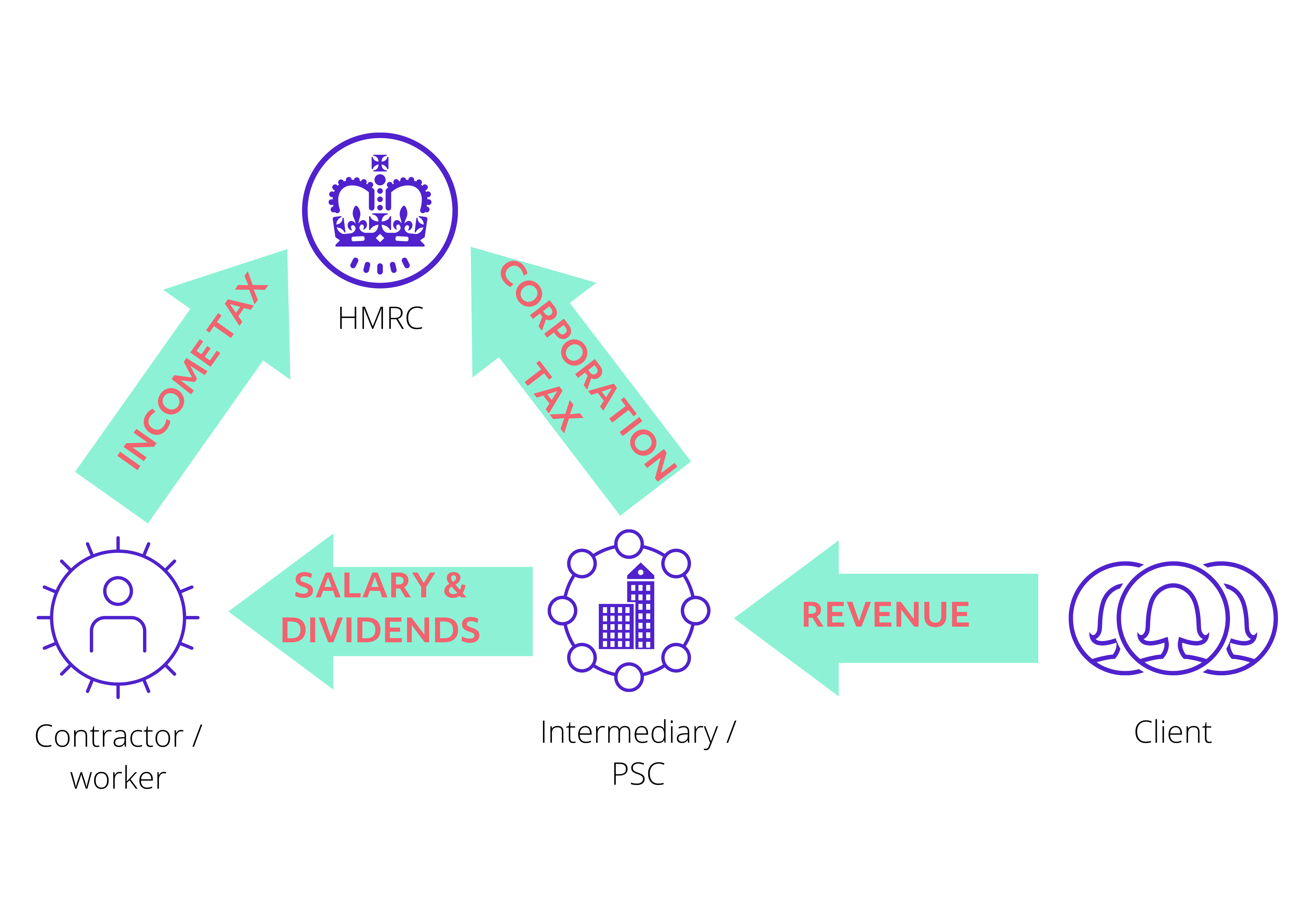

2: Normal employer-employee situation:

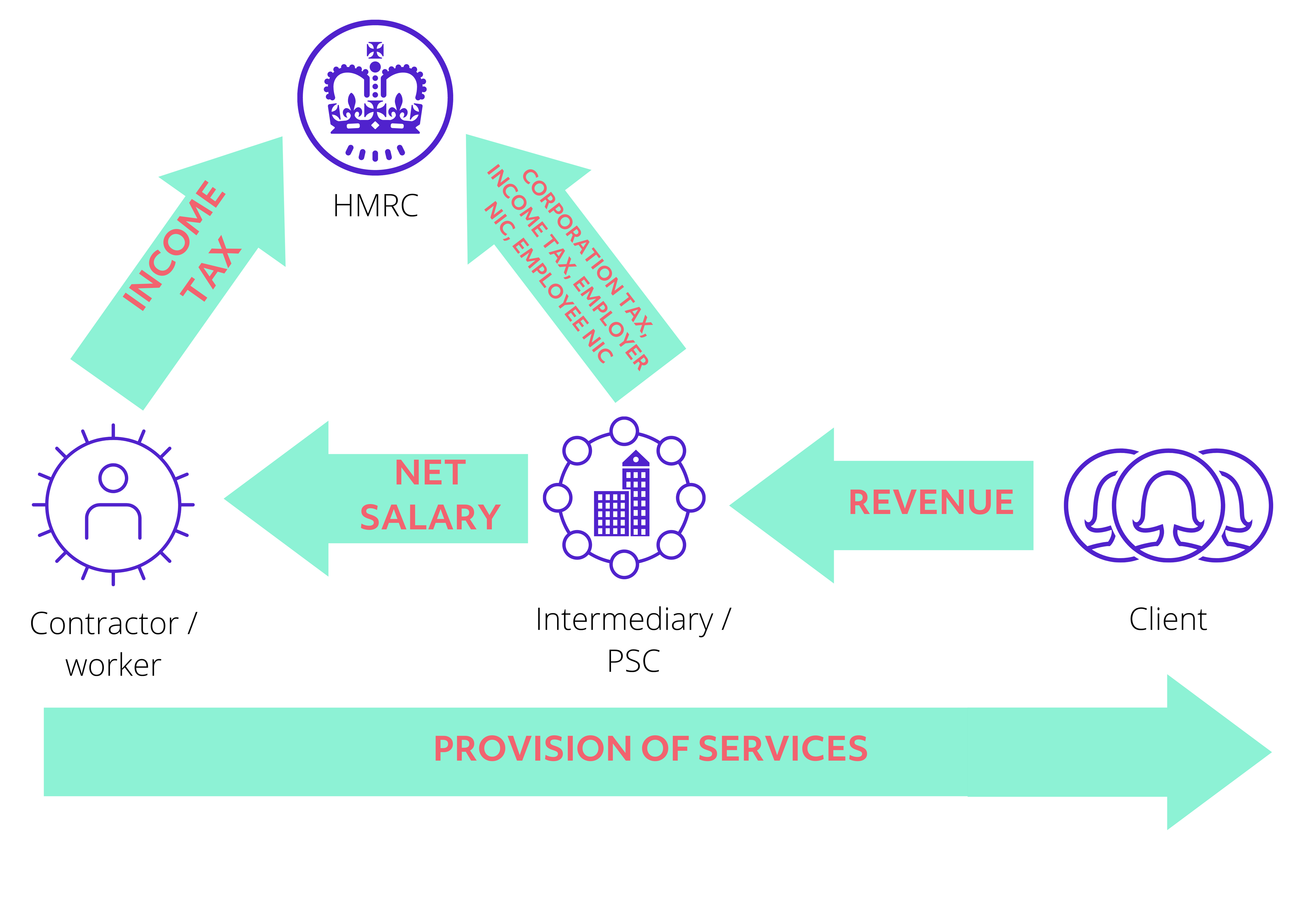

3: Worker subject to off-payroll rules:

As you can see, HMRC is slowly trying to guide workers that fall under the off-payroll rules into becoming full employees.

But why?

Essentially, HMRC believe that only a very small amount of contractors comply with their tax responsibilities, and that they are therefore losing out on additional income. Changing the rules this way will give them far more control over how they receive the relevant taxes due.

There are no plans to use information acquired through the off-payroll rule changes retrospectively (unless they suspect fraudulent or criminal behaviour) but instead HMRC will be looking at ensuring companies implement the required processes going forward. It is therefore important to start the process of reviewing contractors’ status’ now to ensure everything is in place ready for the change

There will certainly be disruption in the contracting market when the new rules come into place and they significant financial implications for many, so if you’re a contractor needing help around off-payroll rules or a business looking to understand these implications further, get in touch with us today. Our tax and payroll specialists will guide you through the changes and help you decide what to do next.