Blog: Budget 2021: 6 key announcements for innovative businesses

On March 3rd the Chancellor Rishi Sunak delivered what was potentially the most important budget we’ve seen in decades. The day where the government lays out its plans for taxation and spending over the next year.

Unsurprisingly focus was on the economic recovery in the wake of the Coronavirus pandemic. Rishi Sunak set out a three-part plan towards economic recovery – supporting those still struggling, paying for the response, and investing in the future economy.

With so many announcements you likely found yourself thinking “what does all this mean for my business?”. Luckily, our tax specialists have analysed the Budget and rounded up everything forward-thinking businesses need to know to help them build back better after the pandemic.

Recovery Loan Scheme

To help businesses through the next stage of the pandemic recovery, a new UK-wide Recovery Loan Scheme will enable businesses, of any size, access loans and other types of finance. This new scheme will be limited to up to £10 million per business.

Businesses that are looking to take up these loans will be able to apply through accredited lenders, whose names will be published on the HMRC website. Eligible businesses will be able to access funds through this scheme, even if they have already received support under the existing COVID-19 guaranteed loan schemes.

The scheme will launch on 6 April 2021 and is expected to remain open until 31 December.

How does the Recovery Loan Scheme work?

The Government will guarantee up to 80% of the finance to the accredited lender. These funds can only be used for legitimate business purposes, including growth and investment. All prospective applicants should note that no personal guarantees will be taken on facilities up to £250,000, and a borrower’s principal private residence cannot be taken as security.

The types of finance that are available under this scheme are:

- Term loans and overdrafts for between £25,001 and £10 million per business.

- Invoice finance and asset finance for between £1,000 and £10 million per business.

Any loan or asset finance facility received through the scheme will have up to six years of loan terms, whilst the overdrafts and invoice finance facilities terms will be up to three years.

Who is eligible for the Recovery Loan Scheme?

You will be able to apply for a loan if your business is trading in the UK and upon application, you will need to show that your business:

- is viable or would be viable were it not for the pandemic,

- has been impacted by the coronavirus pandemic,

- is not in collective insolvency proceedings.

In this instance, the Scheme will not be available for the banks, building societies, insurers and reinsurers (but not insurance brokers), public-sector bodies and state-funded primary and secondary schools.

The scheme will launch on 6 April 2021 and is open until 31 December, subject to review. Further details on how to apply and details of accredited lenders will be released by HMRC in due course.

Help to Grow Scheme

A new Help to Grow scheme has been introduced, offering up to 130,000 companies across the UK access to digital and management programmes.

The programmes will help small and medium-sized businesses across the UK learn new skills, reach new customers and boost profits.

If this is an area that your business would benefit from, we highly recommend that you register your interest at the earliest possible moment. You can do so here.

There are two programmes on offer, the key takeaways are detailed below for both:

1. Help to Grow: Management

This is a 12-week programme delivered by UK leading business schools starting from June this year. Companies will be given 1:1 mentor support, practical curriculum, peer-learning sessions and an alumni network.

If your business is registered in the UK, has been operating for more than 1 year and employs between 5-249 employees, you will be eligible for this scheme. All industry sectors are eligible too.

The participants for the Help to Grow – Management programs will only be eligible if they are decision-makers or members of a senior management team within the business e.g. Chief Executive, Finance Director etc.

The programme is to be run alongside full-time work and is designed to support small business leaders to develop their strategic skills with key modules covering financial management, innovation and digital adoption. By the end of the programme participants will develop a tailored business growth plan to lead their business to its full potential.

30,000 places will be available over 3 years. The programme is 90% subsidised by the Government and participants will be charged £750.

2. Help to Grow: Digital

This Autumn, a new online platform will be available to help small businesses have access to free impartial advice on how technology can boost their performance. This platform will be made available to all UK businesses.

In addition, eligible businesses will be able to get a 50% discount on the cost of approved software in the form of vouchers up to the value of £5,000 to be used on software that helps businesses:

- build customer relationships and increase sales

- make the most of selling online

- manage their accounts and finances digitally

It is expected that to be eligible for the Help to Grow – Digital vouchers, UK businesses should be registered at Companies House, will have been trading for more than 12 months and will have between 5- 249 employees. Vouchers will only be available if the discounted software has been purchased for the first time.

Full details on the businesses and software eligible for the voucher will be published this summer.

Future Fund: Breakthrough

The £375 million UK-wide ‘Future Fund: Breakthrough’ is designed to encourage private investors to co-invest with the Government in highly innovative research & development companies.

In the Budget announcement, it was described that the companies invested in and eligible for this scheme could be working in life sciences, quantum computing, or cleantech. They should also be seeking to raise a minimum of £20 million and will crowd in private sector investment to support their growth.

These R&D intensive companies, accelerate the deployment of breakthrough technologies that can transform major industries, develop new medicines, and support the UK transition to a net-zero economy.

Why has the Government created a new Future Fund scheme?

Due to high costs for research & development, breakthrough technology companies typically require more capital than other technology companies to be able to survive the later stages of their growth.

This new scheme follows on from last year’s government’s Future Fund which is now closed to new applications, addressed the immediate funding challenge that innovative, equity backed, UK companies faced due to pandemic. Businesses that participated in the Future Fund can still apply to obtain funding from Future Fund: Breakthrough.

When will the Future Fund: Breakthrough scheme launch?

The Future Fund: Breakthrough programme will launch in the early summer of 2021 and will be available for UK based companies with significant UK operations with the application to be led by established venture capital investors.

Loss Carried Back

Current rules for losses, mean that companies can carry a loss back 1 year if they’ve made a profit within the previous year and have profits to be carried back to; otherwise the loss is carried forward and offset against future profits.

New rules from 1st April 2021

Changes to the rules mean that from 1st April 2021, companies with an accounting period ending between 1 April 2020 and 31 March 2022 can carry losses back up to 3 years given they have profits available within the previous years, with the losses carried back against the later years first. Carried back losses for the earlier 2 years will be capped at £2 million.

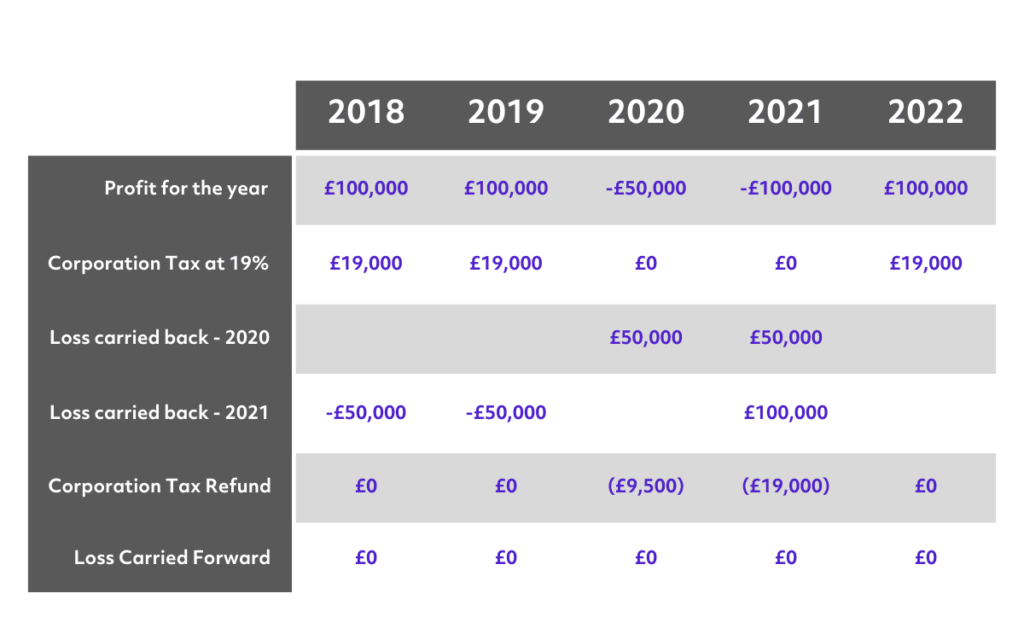

Example: Losses Carried Back Pre-April 2021

Current rules for 2020 mean, the company would not be able to carry back the losses in 2019 and 2020. They would need to be carried forward until the company either makes a profit or closes. Crucially, in 2019 the company here made a small loss which meant only a small portion of the profits could be reclaimed back from HMRC.

Example: Losses Carried Back Post-April 2021

With the new rules, the company would be able to carry the loss made in 2021 back to 2018 getting the all-important cash back into the company. Prior to the recent Budget announcement, these losses would have been carried forward to offset against 2022.

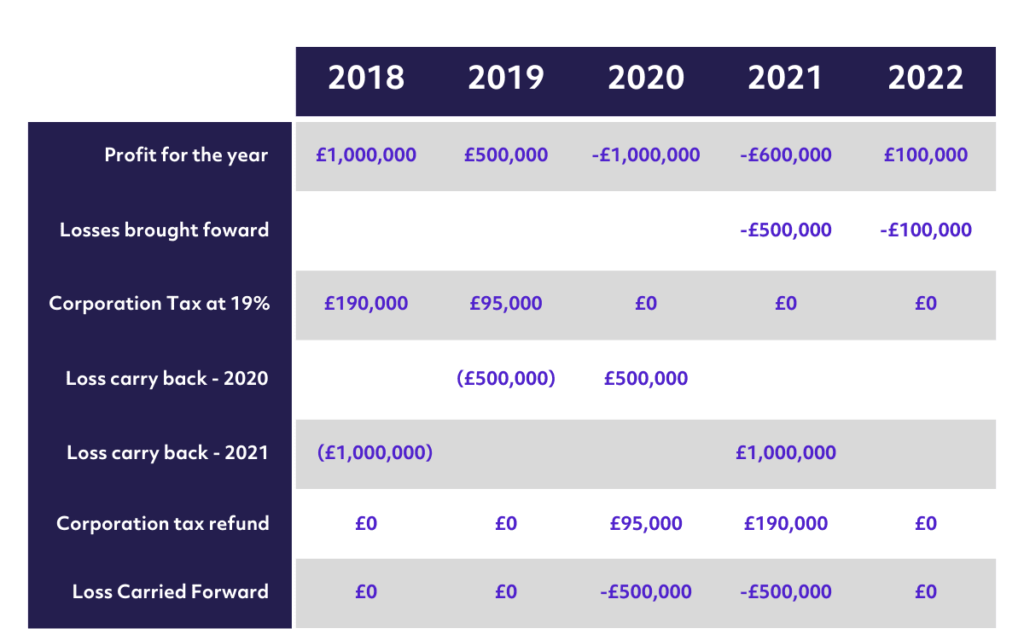

Example: Losses Carried Back Post-April 2021

With the final example, the company can only carry back to 3 years utilising the most recent accounting year first. This means there in this example there is a small loss carried forward which can then be utilised in the 2022 tax year.

Super-Deduction

The new “Super Deduction” capital allowance from HMRC is an increased deduction on any qualifying plant and machinery investments.

For main rate pooled assets, the deduction is a 130% first-year allowance. For special rate pooled assets, the deduction would be a 50% first-year allowance.

What qualifies?

Qualifying expenditure that would fall under the special rate pool would be items that are life-lasting; cars; integral features of a building and thermal insulation of a building.

Anything else would be considered within the main rate pool. The super-deduction will not qualify for used or second-hand purchases. This relief will come into effect from 1st April 2021 and last up to and including 31st March 2023. If the accounting period falls past 1st April 2023 then the deduction could be apportioned based on the days prior to 1st April 2023 within the accounting period.

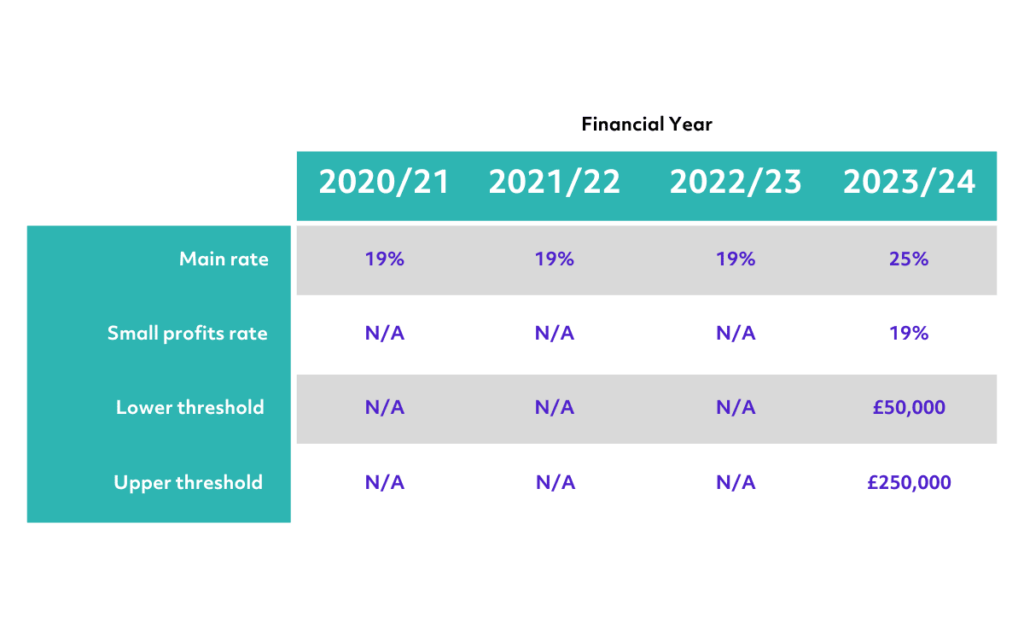

Corporation Tax Rate Changes

The Corporation Tax main rate for all companies will be changing from 1st April 2023.

Corporation Tax rates will be split into 3 different bands.

- The lower limit of £50,000, will continue to be taxed at 19%.

- An upper limit of £250,000, which will be taxed at 25%.

- Between the lower limit of £50,000 and the upper limit of £250,000, the taxable rate will be tapered so only the companies with £250,000 or more in profits will be taxed at the full 25%. HMRC are still yet to release any further information on the tapering.

For an accounting period that straddles 1st April 2023 when the new rate is introduced, the new rate will be apportioned to the number of days after 1st April 2023 within the accounting period.

Already innovating?

If you are already innovating or involved in research and development activities, you may be eligible to take advantage of two other Government schemes that are already in play: The R&D Tax Credits scheme and Patent Box relief. Both Government-backed schemes provide tax relief on already incurred costs.

Our experts are always on hand to give you and your business advice on funding and tax opportunities. Please get in touch with us for a free business review call.

Get in touch for a free business review today