Manufacturing soars due to Brexit stockpiling

- Manufacturing

- Economy

- 2 Min Read

Manufacturing levels grew faster in December than at any point in the last three years, according to new data.

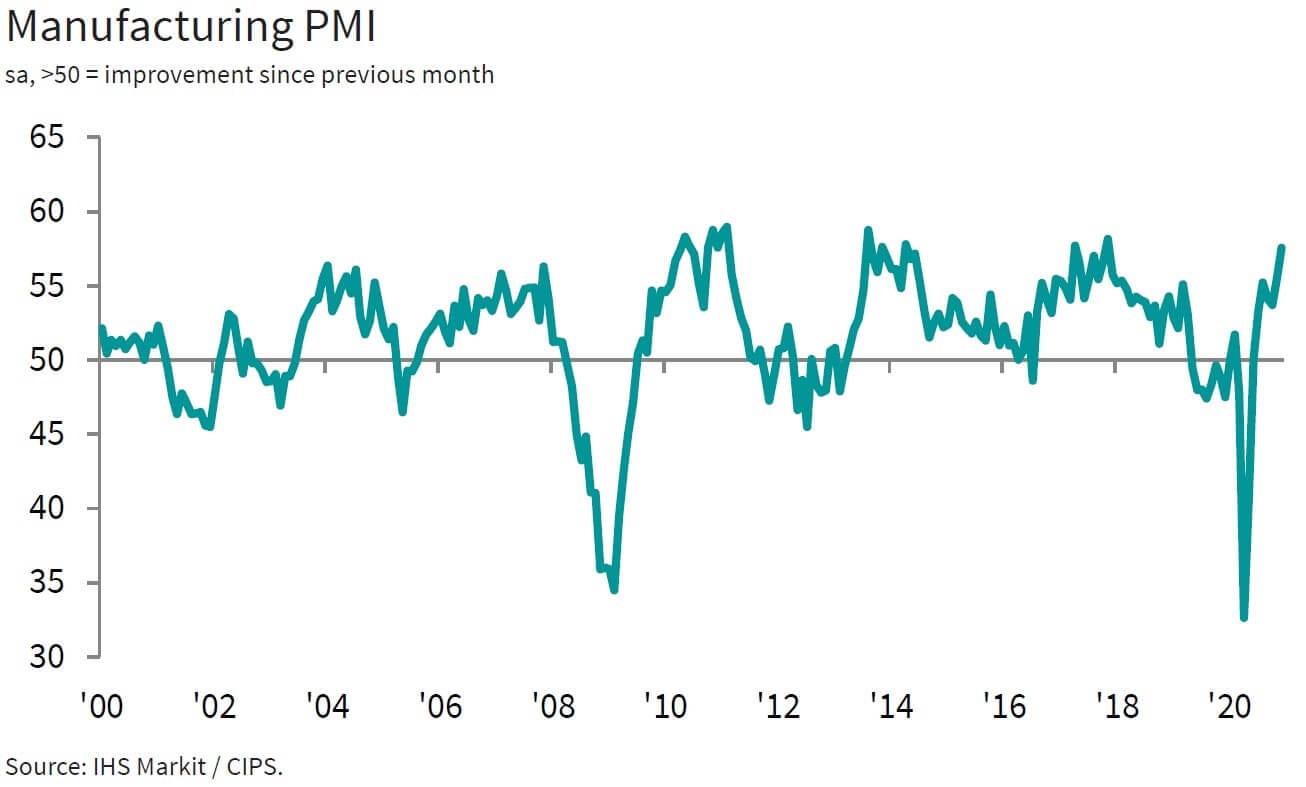

The closely followed IHS Markit/CIPS Purchasing Managers’ Index (PMI) hit a 37-month high of 57.5 in December, up from 55.6 in November – anything above 50 is seen as a sector in growth – but researchers cautioned that the boost was primarily due to pre-Brexit stockpiling.

Analysts said clients brought forward orders to beat the end of the Brexit transition period due to finish on December 31 and warned that the sector could decline in the first few months of 2021.

Delays at ports and logistical disruptions meant supply-chain delays also lengthened to one of the greatest extents in the survey’s history, they added.

Output rose for the seventh consecutive month in December, albeit to a lesser extent than in November, with growth across the consumer, intermediate and investment goods sectors.

Consumer goods sales had fallen back in November, but the end of the lockdown and brief reopening of all retailers at the start of December helped it return to growth.

Overall, the amount of stock purchased throughout the manufacturing sector rose to its third-fastest rate in the 29-year survey history, as heavy stockpiling took place.

As a result, suppliers saw substantial disruption to supply chains – despite the survey taking place before the border between France and the UK was closed due to Covid-19 fears.

Rob Dobson director, IHS MarkitThe sector is holding its breath until the terms of the new deal are fully understood and whether new business can be sustained in the same way in a post-Brexit marketplace

Rob Dobson, director at IHS Markit, which compiles the survey, said: “Customers, especially those based in the EU, brought forward purchases, boosting sales temporarily. It seems likely that this boost will reverse in the opening months of 2021, making for a weak start to the year.

“Note also that the December PMI data were collected prior to the border closures, which will have led to further logistics and production disruptions for many companies.

“Worryingly, the manufacturing sector was already beset by near-record supply-chain delays even prior to the closure of Dover-Calais shipping.

“Manufacturers reported freight delays – especially at ports – plus shortages of certain raw materials and a lack of supplier capacity.

“Vendor lead times, a bellwether of supply-chain pressures, lengthened in December to a similar extent to during the first wave of the pandemic.”