Infographic: Does your construction business qualify for this funding?

- Construction

- R&D Tax Credits

- Innovation

- 5 Min Read

Because this definition is broad it’s not surprising that many business owners don’t understand or can’t quickly see whether activities they’ve undertaken fit the bill.

But the construction sector is diverse, and research and development can be found in many of the industry verticals – including across the supply chain.

If you can identify any projects or even everyday challenges that you’ve had to solve with new ideas, technologies or techniques, then you may qualify for research and development tax relief.

The average claim value is over £63,000 so it’s worth taking the time to explore further.

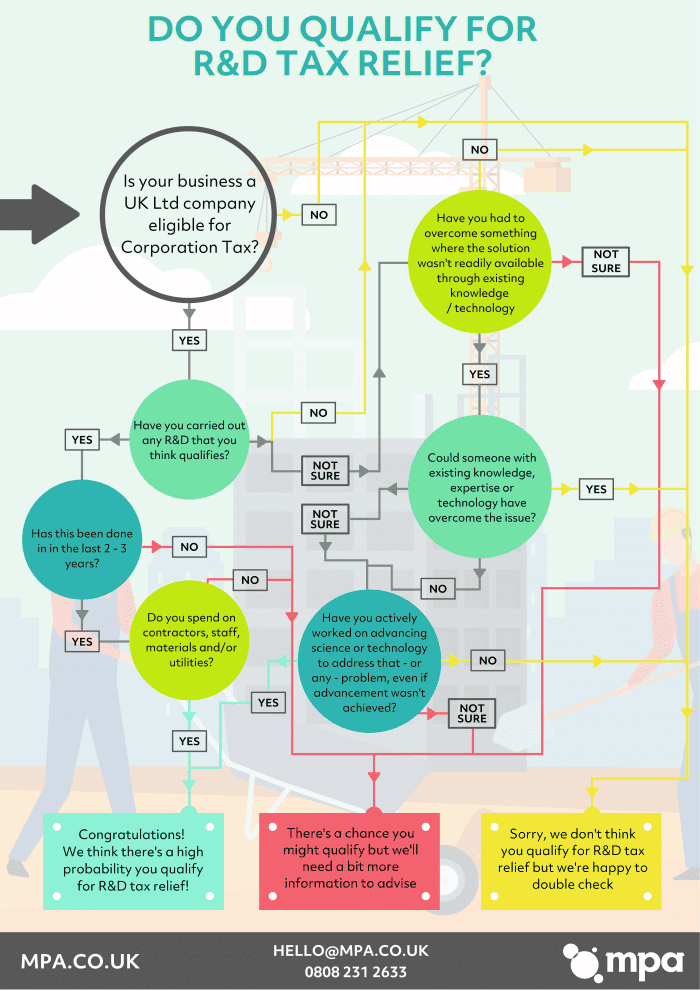

To help you identify qualifying activity already happening in your business we’ve developed a download and print decision tree to guide your thinking.

Used in conjunction with our Funding innovation in construction guide it’ll help uncover areas of work you might not have considered as R&D, and give you a framework for starting internal discussions about filing for relief.