Contact us

Whether you’re looking for more information about our services, have a burning question you need answering, or want someone to help you realise your ideas and overcome your challenges, we’re always here.

R&D Tax Credits

Imagine having an extra £54,000 to invest in growing your business.

At MPA, we are passionate about empowering innovative businesses in the UK. As one of the leading tax consultancy specialists in the country, we actively champion the evolving R&D landscape, constantly striving to maximize the benefits that businesses can receive through tax credits. With an average claim value of £54,000, we believe that these credits have the potential to transform the way businesses operate and drive the country’s economic growth.

What you will learn on this page:

What are R&D tax credits?

Research and Development (R&D) tax credits are a UK tax relief designed to incentivise and reward companies that are engaged in innovation. These tax credits can provide valuable funding for any company that’s spending money on developing new products and processes or improving existing ones. This is done by claiming back a proportion of their R&D expenditure as tax credits, businesses can reduce their tax bill or increase taxable losses.

Am I eligible for R&D tax credits?

The work that qualifies for R&D tax relief must be part of a specific project to make an advance in science or technology. You cannot claim if the advance is in:

• The arts

• Humanities

• Social sciences, including economics

The project must relate to your company’s trade, either an existing one or one that you intend to start up based on the results of the R&D. To claim you need to explain how a project:

• Looked to advance the field

• Had to overcome the scientific or technological uncertainty

• Tried to overcome scientific or technological uncertainty

• Could not be easily worked out by a professional in the field

Things to consider about your Project:

Advances in the field

Your project should focus on advancing the entire field, rather than just benefiting your own business. Even if another company has created the process, product, or service but has not been made available to the public, it can still be considered an advance.

Show there was a scientific or technological uncertainty

If your company or an expert is unsure whether something is possible or how to do it, despite checking all available evidence, it’s called a scientific or technological uncertainty. This means that the solution or advancement is unknown to your company or experts in the field.

Explain how you tried to overcome the scientific or technological uncertainty

To claim R&D tax relief, you need to demonstrate that your project faced scientific or technological uncertainty. You can do this by showing that the R&D required research, testing, and analysis to develop it. To explain the work, you did to overcome this uncertainty, you need to describe the successes and failures you encountered during the project.

Show that a professional in the field could not work this out

To qualify for R&D tax relief, demonstrate why a professional couldn’t easily find a solution. Highlight failed attempts, scientific uncertainties, and the expertise of your team. If unsure, check with the relevant authorities.

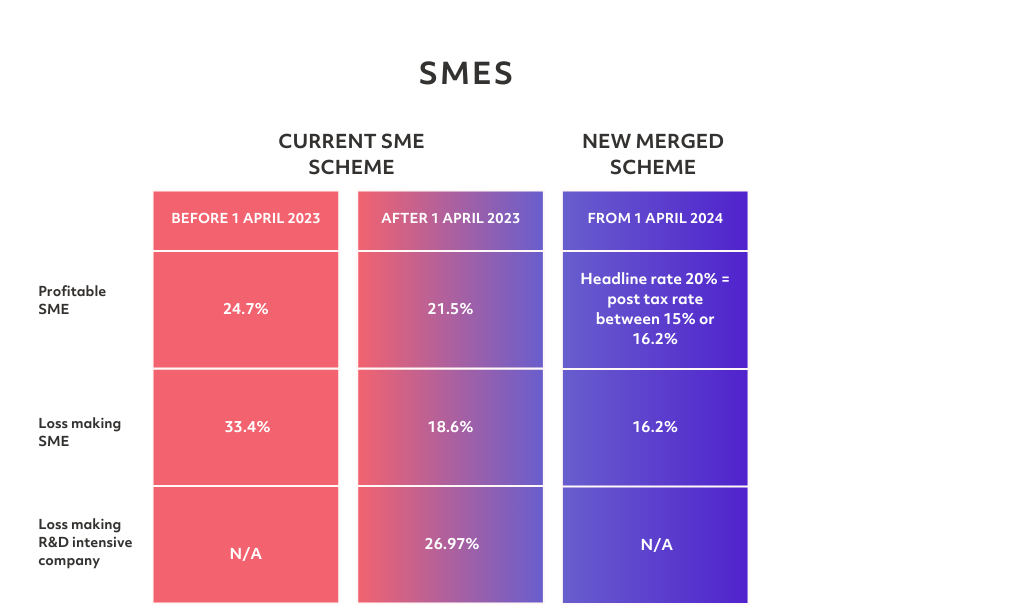

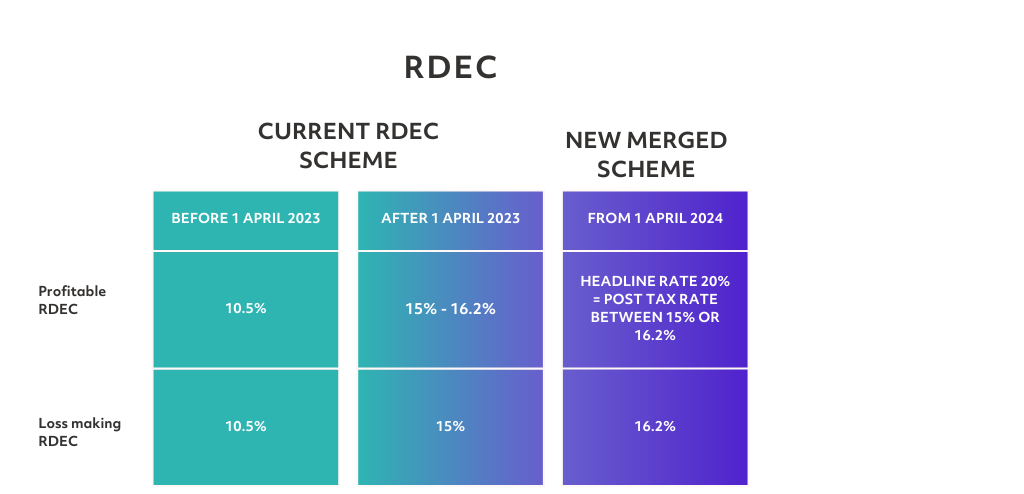

Types of R&D tax relief

Over the past few years, there have been significant changes to the Research and Development (R&D) tax incentive schemes and R&D Expenditure Credit (RDEC) schemes. As of April 1st 2024, both R&D SME schemes were combined into a single, merged scheme. The new scheme introduces an “above-the-line” credit, which enables companies to claim their qualifying R&D costs, including contracted-out R&D. The change from April 1st is for accounting periods after 1st April 2024, not claims made after April 1st.

For more detailed information about the new merged scheme, read our R&D tax relief: the merged scheme blog.

What are the current R&D tax credit rates?

The tables below show how R&D tax relief rates have changed in recent years. The merged scheme applies for accounting periods beginning on or after 1 April 2024. For businesses submitting claims for accounting periods before 1 April 2024, they will need to refer to the previous rates.

How can MPA help you claim?

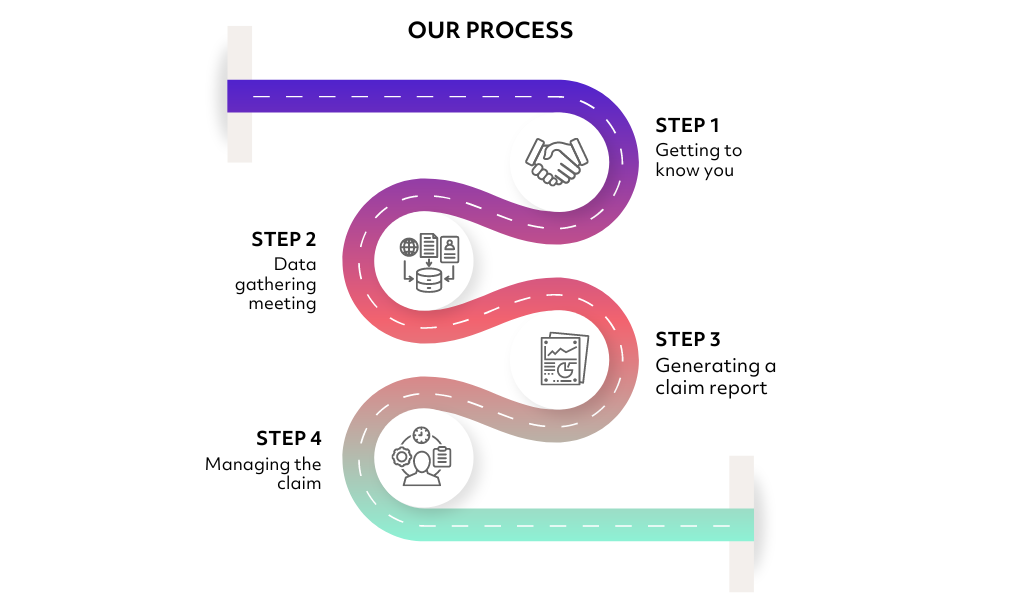

1 Step 1: Getting to know you

We know that every business is built in a slightly different way. So an integral part of our process is to get to know you and your business to find out what is important to you, where you are in the market and where you want to go. With a team of analysts based across the country, we have the flexibility to offer either a phone call or an onsite visit. We know that time is a major factor in all businesses, so we can be flexible and work around you. In this meeting we would usually explain our processes and how we will work together.

2 Step 2: Data gathering meeting

As much as we take up most of the work in preparing your claim, we do need your input. In this meeting we get into the detail of what your company does and which projects will form your claim. HMRC have outlined a set of criteria in order to identify eligibility, our technical analyst will explain what these are and identify which of your products or services would qualify for the scheme.

We have found that using technical analysts with experience in your specific sector, is a great way of identifying the aspects involved in creating or making a product or new process. With an understanding of the iterative steps that can be found in daily activities they are able to uncover details that can help maximise your claim value.

3 Step 3: Generating a claim report

The technical report is an outline of the processes involved in the creation of your product or service and the financial evidence of your spending around it. HMRC have a level of detail that they require to be included in a report and we have an internal team that will ensure that the report meets these. Before we submit the technical report a draft will be sent to you for review.

Our aim is to make sure that you can continue to realise your maximum potential through innovation. And in order to ensure that you receive the maximum R&D tax relief possible, our process in submitting your claim includes a review of your company financials by our team of tax specialists, who will agree on your tax position and notify you of any changes to optimise your overall tax position.

4 Step 4: Managing the claim

Once you have signed off the technical report we will submit it to HMRC. We are confident in our process and as a standard part of our service we provide enquiry defence, so in the event that HMRC has any questions, we will communicate with them on your behalf.

HMRC has its own internal process which can sit outside our estimated delivery times, but our dedicated support team maintain regular communication so that we can keep you updated on the progress of your claim. If your business needs early access to your R&D Tax Credit benefit, we have an R&D Advanced Funding option that may be suitable.

Once the claim is successful and HMRC has made payment of your claim we will pass the money directly on to you with a detailed explanation of how the tax savings have been calculated and applied.

Ready to talk to us?

Unleash the full potential of your business by getting in touch with us. With our range of services including R&D tax credits, grant services, accounting and tax, we can offer a bespoke solution that’s tailored to your needs. Let us help you take your business to the next level.